|

|

BMe Research Grant |

|

Doctoral School of Business and Management

Department of Economics

Supervisor: Dr. Ligeti Zsombor

Montezuma’s Revenge

Introducing the research area

Tourists visiting Mexico are often afflicted by the traveler’s diarrhea, a disease also known as the revenge of the last Aztec emperor, Montezuma II. The pirate legend says that before his death Montezuma had cursed the conquistadors with everlasting hunger, pain, and suffering... Although in a way different form, his revenge finally reached out to the Spanish Empire; the absolute superpower of the 1500s ended up as a relatively small and poor country by the end of XIX. century. Instead of bringing a new golden era, the enormous amount of looted treasure from the colonies drove the Empire to fall apart (Drelichman, 2005).

Montezuma’s revenge seems to be persistent: Venezuela, a former colony which now controls over the largest proven oil-reserve of the World, is currently a scarce-economy devastated by hyperinflation and political mismanagement. Moreover, most of the resource abundant countries in the Middle-East, South-America, and Africa are facing similar problems. Although classic theories consider natural wealth as a productive component of capital and associate it with positive growth effects, the disappointing development outcomes tell us a different story (see Figure 1). My research is focused on the paradox of plenty (a.k.a. the resource curse), a concept that aims to explain the counterintuitive impact of natural resources on economic growth and social development.

Figure 1: Natural resources and economic growth, source: Szalai, 2011, p. 118.

Brief introduction of the research place

The traditional fields of research at the Department of Economics include the theoretical and empirical investigation of macroeconomic growth models, as well as the evaluation of the related policy proposals. Besides that, our portfolio also covers several topics from international and institutional economics, economic history, and game theory. My research is largely based on the synthesis of this knowledge.

History and context of the research

Due to its well-developed theoretical background, resource economics has not been a hot topic and was mostly concerned about the optimization of extraction, production, and transportation. Commodity exports were associated with improving trade balance, more investments, higher employment, and thus, with economic growth and social development. Moreover, the so-called big-push theory argues that a resource boom generates positive spillovers that might finance the relatively high sunk costs of industrialization and infrastructural developments, help achieve the economies of scale, facilitate the accumulation of human capital, and ultimately release the country from the low-income trap (Murphy et al., 1989). In the ‘90s however, influential empirical papers found contradictory evidence that inspired further investigations and kicked-off an intense academic debate about the resource curse (Sachs & Warner, 1995, 1997, Salai-i-Martin, 1997). Later, the problem turned out to be even more complex: The impact of natural wealth is indirect, conditional, and non-monotonous, leading to significantly different growth experiences. The Dutch disease (Corden & Neary, 1982), as a classic theory, was useful to explain some of the negative effects but failed to describe the variety of the development outcomes. My investigation aims to develop a coherent theoretical framework that explains not just the paradox of plenty but also the resource-driven success stories, such as Norway or Botswana.

The research goals, open questions

My research is focused on the better understanding of the complex growth effects of abundant natural resources. Despite the recent academic interest, the paradox of plenty still remains an open question (Papyrakis, 2016): The fragmented theoretical background and the inconsistent empirical results, like pieces of a puzzle, are up to be assembled. My goal is to organize these pieces and develop a coherent theory of the resource curse. In order to achieve that, I am seeking the answers for the following questions:

● Is the paradox of plenty a general phenomenon or just a statistical mirage (James, 2015) that depends on the specification of the empirical models?

● What conditions catalyze the resource curse?

● What are the most significant indirect transmission channels?

● What makes the difference between successful and stranded resource-economies?

● What economic policies have the potential to turn the curse into a blessing?

Methods

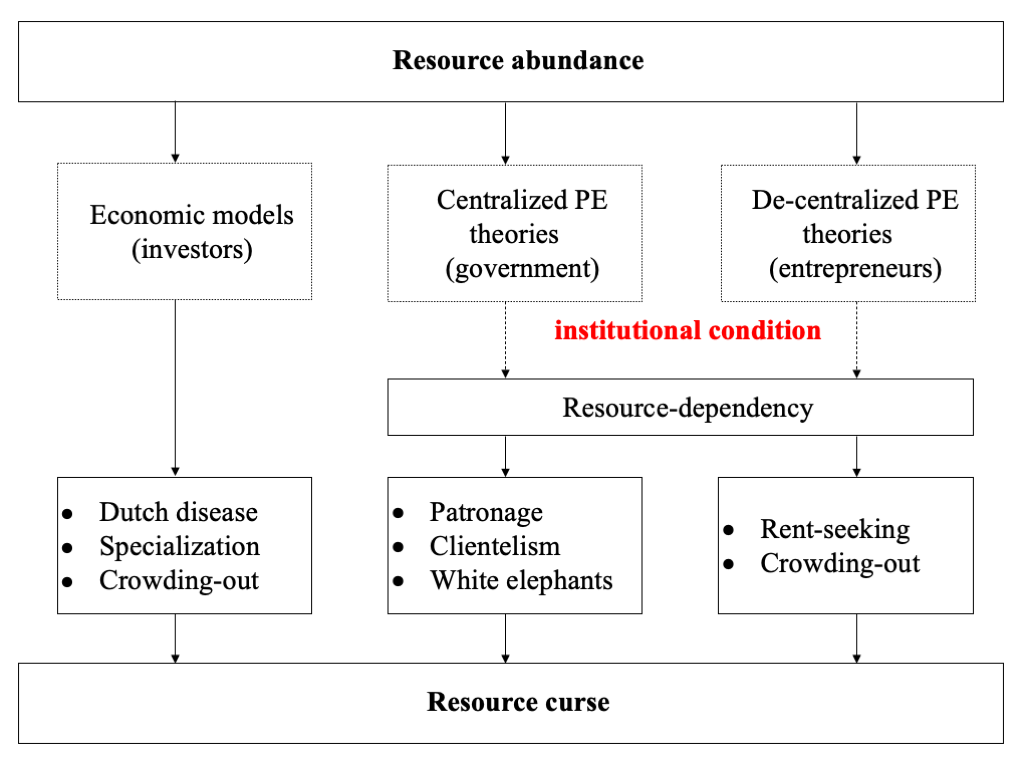

Standing on the shoulder of giants, my research is mostly focused on the synthesis of our current knowledge. In my thesis, I will summarize the conclusions from around 300 scientific papers, while in case of outdated, incomplete, or controversial results, I intend to improve our understanding by original contributions. Using an interdisciplinary approach, I discuss the paradox in terms of micro- and macroeconomics, international and institutional economics, political economy, and game theory (see Figure 2), while I also attempt to integrate the most relevant theories from social and environmental sciences.

Figure 2: Theories explaining the resource curse, source: Szalai, 2018a, p. 183.

In my recent research, I was using regression analysis to investigate the nexus of natural resources and economic growth, as well as to replicate and re-validate earlier empirical results. With a particular interest in the role of the institutional quality (Acemoglu et al., 2001) and the so-called appropriability hypotheses (Boschini et al. 2007), I am developing a gamified classroom experiment to resemble the growth effects under different institutional conditions. Furthermore, I am working on a project aimed to investigate the practical relevance of the classic Dutch disease theory: Using non-linear autoregressive models, we test if there is a cointegration between the diamond price index and the real exchange rate of the Botswana pula (Barczikay et al, 2020).

Results

I began my research by checking the robustness of the existing empirical evidence. I was not just replicating the original investigations but also implemented the methodology to different country samples and updated datasets (Szalai, 2011, 2018a). Based on my results, I concluded that the resource curse is conditional, while the growth effects are largely dependent on the institutional framework (Szalai, 2018b) and on the physical properties of the resources. I found new empirical evidence supporting the appropriability hypotheses, suggesting that:

- “The effect of natural resources on economic development improves with institutional quality” and

- “The interaction of institutional quality and natural resources depends on the type of resources.” (Boschini et al., 2007, p. 599)

Put differently, the resource curse only hits the economy if technically appropriate resources (point-source extraction, easy to process, store, and transport) are coupled with low quality institutions (in terms of property rights, freedom of speech, transparency, and accountability). The aim of my “resource game” concept is to test this theory in an experimental setting. Based on a competition between self-interested individual actors, the design features both an economic and a political framework to capture the development outcomes under different institutional conditions. Organized as a turn-based game of sequential decisions, it offers economic actors a choice between rent-seeking and productive activities, whereas a political election mechanism provides scope for endogenous policy-making and controls for the extraction of the resource pool. The experiment yields a time-series of macroeconomic indicators as aggregate measures of individual activities. Results from iterated gameplay under different initial conditions are expected to provide new experimental evidence of the curse and a better understanding of its transmission channels (Szalai, 2020).

Furthermore, in accordance with the classic theory, our investigation of the Dutch disease in Botswana concluded that diamond prices do drive the real appreciation of the pula, causing significant losses in competitiveness and crowding-out in the manufacturing sector. The de-industrializing effect of the diamond boom raises serious concerns as the accessible reserves are expected to deplete by the end of this decade. We suspect that this mechanism hinders diversification in several resource abundant economies, while we also intend to involve more countries into our research (Barczikay et al., 2020).

I was lucky enough to have numerous opportunities to advocate for my/our ideas in international scientific conferences, as well as to instruct guest lectures and academic courses at universities in Hungary, Finland, Mexico, and Spain. Besides Hungarian and Spanish, most of my papers were written in English, including original research articles published in recognized international journals.

Expected impact and further research

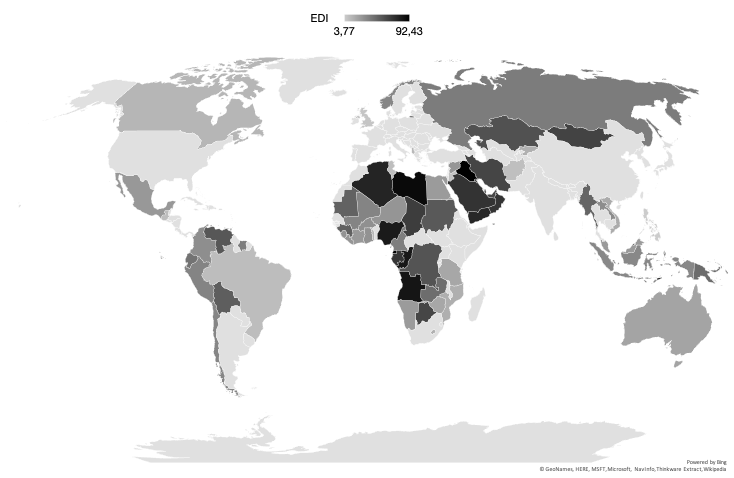

Most resource-abundant economies classify as a developing country (see Figure 3) and many of them are still struggling with Montezuma’s revenge. A better theoretical understanding of the paradox will provide a strong basis to implement more efficient policies, exorcise the resource curse, and escape the low-income trap. My ultimate goal is to contribute to the development of a consistent theoretical framework, while on the short run I will continue with an ongoing research focused on the dynamic modeling of exchange rates (Tóth-Bozó & Szalai, 2019) and the better understanding of the Dutch disease. As a spillover related to the aforementioned experimental concept, we are investigating the opportunities to implement gamification as a teaching technique to improve the entrepreneurial competences among university students (Guillén Tortajada et al., 2020).

Figure 3: Resource-dependent economies, source: EITI

Publications, references, links

List of corresponding own publications

Barczikay, T., Biedermann, Z., & Szalai, L. (2020). An investigation of a partial Dutch disease in Botswana. Resources Policy, 67, 101665. DOI:10.1016/j.resourpol.2020.101665

Guillén Tortajada, E., Jiménez Martínez, M. P., Szalai, L., Caballero García, P. A., & Alcaraz Rodríguez, R. E. (2020). Instrument Design and Validation for Measuring Entrepreneurial Competence. Comunicación y Hombre, 16, 193–224. ISSN:1885–365X

Szalai, L. (2011). Paradox of Plenty. In L. Balogh, D. Meyer, & H.-D. Wenzel (Eds.), Analysis of Monetary Institutions and Space (pp. 111–138). Bamberg: BERG-Verlag. ISBN:978-3-931052-94-2

Szalai, L. (2018a). A Review on the Resource Curse. Periodica Polytechnica Social and Management Sciences,26(2), 179–189. DOI:10.3311/PPso.10021

Szalai, L. (2018b). Institutions and Resource-driven Development. World Journal of Applied Economics, 4(1), 39–53. DOI:10.22440/wjae.4.1.3

Szalai, L. (2020). An Experimental Approach to the Resource Curse. In G. Družić & T. Gelo (Eds.), Conference Proceedings of the International Conference on the Economics of Decoupling (pp. 289–308). Zagreb, Croatia: University of Zagreb. ISBN:978-953-347-337-6

Tóth-Bozó, B., & Szalai, L. (2019). Political Announcements and Exchange Rate Expectations. World Journal of Applied Economics, 5(2), 53–66. DOI:10.22440/wjae.5.2.2

Table of links

Conference presentations

Empirical Investigation of the Appropriability Hypotheses (Budapest, 2013)

Social Consequences of the Resource Curse (Kaposvár, 2016)

Institutions and Resource-driven Development (Lisbon, 2018)

An Experimental Approach to the Resource Curse (Zagreb, 2019)

Further links

Experiment in Practice (video)

Universidad Anáhuac (Cancún)

Universidad de Francisco de Vitoria (Pozuelo)

Saint Louis University (Madrid Campus)

List of references

Acemoglu, D., Johnson, S., & Robinson, J. A. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401. DOI:10.1257/aer.91.5.1369

Boschini, A. D., Pettersson, J., & Roine, J. (2007). Resource Curse or Not: A Question of Appropriability. Scandinavian Journal of Economics, 109(3), 593–617. DOI:10.1111/j.1467-9442.2007.00509.x

Corden, M. W., & Neary, P. J. (1982). Booming Sector and De-Industrialisation in a Small Open Economy. The Economic Journal, 92(368), 825–848.

Drelichman, M. (2005). All that glitters: Precious metals, rent seeking and the decline of Spain. European Review of Economic History, 9(3), 313–336. DOI:10.1017/S1361491605001528

James, Alexander. (2015). The resource curse: A statistical mirage? Journal of Development Economics, 114, 55–63. DOI:10.1016/j.jdeveco.2014.10.006

Murphy, K. M., Shleifer, A., & Vishny, R. W. (1989). Industrialization and the Big Push. Journal of Political Economy, 97(5), 1003–1026. DOI:10.1086/261641

Papyrakis, E. (2016). The Resource Curse - What Have We Learned from Two Decades of Intensive Research: Introduction to the Special Issue. Journal of Development Studies, (April), 1–11. DOI:10.1080/00220388.2016.1160070

Sachs, J. D., & Warner, A. M. (1995). Natural Resource Abundance and Economic Growth (NBER Working Paper No. 5398). Cambridge.

Sachs, J. D., & Warner, A. M. (1997). Fundamental Sources of Long-Run Growth. The American Economic Review, 87(2), 184–188.

Sala-i-Martin, X. (1997). I Just Ran Two Million Regressions. The American Economic Review, 87(2), 178–183.